Offshore Europe: Potential 4 billion BOE to be accessed form UK brouwnfield developments

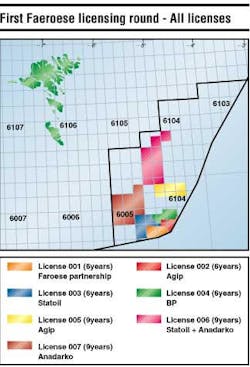

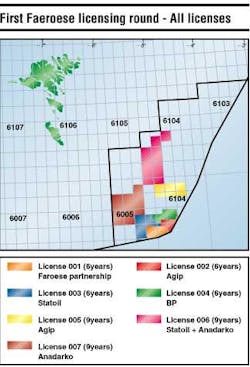

Map shows blocks awarded under the first Faeroese licensing round. The semisubmersible Sovereign Explorer recently spudded the first well in Faeroese waters.

Judging by events in the fabrication sector, UK activity looks to be grinding to a halt. The Barmac joint venture in northern Scotland has dissolved, leading to probable closure of the specialist jacket yard in Ardersier. Kellogg Brown and Root Caledonia assumed control of the remaining yard in Nigg, but that facility has no current construction work beyond rig repairs. Consafe, Lewis Offshore and Kværner also closed or mothballed three sites. Of those left standing, some are being sustained only by Shell's Bonga project offshore Nigeria.

But field development is hardly in a trough - it's just that priorities in the UK North Sea have changed. The focus is on sustaining existing infrastructure through incremental subsea developments. Most of the major operators have schemes under way, including:

- ExxonMobil's Skene, a $350 million project to recover 95 million BOE, involving a subsea manifold/tieback to the Beryl Alpha platform (a standalone installation had also been considered).

- TotalFinaElf's Otter, discovered in 1977, will finally be produced through five subsea wells, three equipped with electrical submersible pumps, for an outlay of $203 million. The host platform will be Shell's Eider 22 km away.

- Shell's four-structure Penguin cluster, discovered in 1974, will be exploited through five drill centers/manifolds, subject to pending UK government approval. These will produce through a 67 km pipe-in-pipe flowline to Shell's Brent C platform, representing the North Sea's longest subsea tieback. Analyst Britboss estimates recoverable reserves at 500-600 million BOE, including 170 million bbl of oil.

- Chevron's Alba Extreme South, recently submitted to the government, is a phased development covering the southern area of block 16/26. The first phase, estimated at $200 million, would require drilling six producer and two water injector wells, a production manifold and a pipeline bundle, all connected to the Alba Northern platform. A second six-well production manifold could also be added. Chevron had considered installing a mini TLP and wellhead platform before settling on the subsea approach. Chevron may also select Alba Northern to process the much smaller Caledonia oil accumulation, located 6 km north of the platform.

- BP is looking at maximizing recovery from various undeveloped structures associated with Don in the Thistle area, with collective oil in place estimated at 180 million bbl. Don itself produces through subsea wells to the Thistle platforms - ideas are thought to include new wells and an additional manifold, with production heading through the Magnus or Penguins infrastructure, rather than through Thistle.

Maintaining throughput

Phillips' Jade is the only new platform-based development in the UK sector outside the southern gas basin.

Unlike the competition, BP also sees scope for adding platforms to maintain mature field throughput. Reportedly, it is considering de-manning the five existing installations on its Forties stronghold and installing a new processing platform, linked to Forties C. This could be instrumental in its stated aim to recover a further 400 million bbl from the field.

Elsewhere, BP is planning to install a minimum facilities gas processing platform alongside the Harding production jackup unit. This would be used partly to export Harding's gas (currently re-injected), but also to handle supplies from the undeveloped Devenick 20 km away, and more ambitiously Rhum 90 km to the south. Wellhead platforms could be added to both these fields, where combined reserves are estimated by Britboss at 800 bcf.

BP could provide further breathing space to UK fabricators by opting for a small, unmanned platform for its 100 million BOE Kessog discovery in central block 30/1c. However, this is a remote, highly compartmentalized high-pressure/high-temperature (HP/HT) structure. A team, to include Halliburton/Cooper Cameron, Schlum-berger/M-I Fluids, and Baker Hughes, was recently appointed to examine well engineering issues. If they can identify suitable enabling technologies, a confirmation well will follow next year, possibly leading to a $350 million development.

Awaiting solutions

Other discoveries are awaiting solutions:

- Kessog is one of numerous problematic fields awaiting creative solutions under the Satellite Accelerator Initiative, formed by the UK oil industry body, Logic.

- Amerada Hess' Solan and Strathmore Fields (67 million bbl cumulative) in the East Solan Basin, west of the Shetlands. Br vig/RDS is working on reservoir definition and characterization.

- Phillips is seeking answers for Jill and Julia, much smaller accumulations close to its Judy/ Joanne complex.

In June, Logic also announced a new brownfield study, led by Aberdeen-based benchmarking consultant Aupec. The study will analyze reserves, development, and cost data supplied by BP, Enterprise, Kerr-McGee, Shell, Talisman, and TotalFinaElf, to identify trends that encourage or discourage mature field development on the UKCS. Logic believes an extra 4 billion BOE could be recovered.

The value of these initiatives is questionable, however. Contractors appear to be putting in the conceptual man-hours with few detailed engineering awards to show for it. Ultimately, other factors come into play, such as acreage swaps. Under a recent deal, BP increased its stake in Phillips' HP/HT Kate discovery in block 22/28a to 82.74%, and has since applied to become operator. This could spur a joint development with Shell's overlapping Tornado Field.

In return, Phillips raises its interest in exploration acreage close to Judy/Joanne, which includes a Paleocene discovery. A week later, Enterprise bought Petrobras' UK assets. The latter's exit urge had been frustrating numerous imminent small oil and gas developments.

'World class' Buzzard

While the majors build up their bases in the North Sea, the onus is on independents to open up new exploration fairways. Talisman discovered Lucy in its Flotta Catchment Area in March, but that was overshadowed shortly afterward by Buzzard in central block 20/6-3, described by operator PanCanadian Petroleum as a potential world-class accumulation. The well was drilled by the Ocean Nomad semisubmersible in 320 ft water depth, and encountered a 360 ft oil column.

The well flowed 6,547 b/d of light oil and 0.97 MMcf/d of gas through a 35/64-in. choke. A subsequent sidetrack extended the estimated length of that column to 750 ft. Both wells contain more than 250 ft of hydrocarbon-bearing sandstone, and PanCanadian estimates recoverable reserves in this part of the structure alone at 200-300 million bbl. Two to three more wells are planned this fall.

Early next year, Marathon may resume appraisal drilling on its 1994 Dragon gas discovery 33 km off the Wales coast. If it can determine the reservoir extent, and quality, a minimal subsea facilities development would follow, the first of its kind in the Welsh sector. The nearest producing complex in the Irish Sea is BHP's Liverpool Bay to the north. Here the operator is developing the 75-bcf Hamilton East accumulation through a single subsea well tied back to the Douglas platform.

In the same area, Burlington Resources is in the market for a production platform for its Rivers gas development, with the sour gas piped to a new sweetening plant located either in Barrow, northwest England, or the Welsh island of Anglesey.

West of Shetlands

The one area set for a concerted drilling campaign is west of the Shetlands, where this May the UK government issued 12 new exploration licenses. Late in August, BP was due to start work on one of these, with a well on the Assynt prospect in block 204/18. It will be managed by the drillship West Navion in 960 meters water depth, northwest of BP's Foinaven and Schiehallion fields.

This summer, Conoco has also been drilling block 204/15, close to acreage containing the 100-million-bbl Suilven discovery. Of the other newly appointed licensees, Amerada Hess and Texaco were the most successful, each operating five blocks or part-blocks. Beyond the current BP well, a further six commitment wells have been confirmed by the other license holders.

Three of Amerada's blocks border acreage awarded to the same operator last August under the first Faeroese licensing round. Amerada will start drilling its Marjun prospect this fall, using the semisubmersible Sovereign Explorer. Recently, this rig spudded the first exploration well in Faeroese waters in license 6003, for operator Statoil. The location is 130 km southeast of the Faeroe Islands in 1,000 meters water depth, in prospective acreage close to the UK median line. Once the West Navion finished its assignment, it will move north to drill the Svinoy license for BP.

Both drilling vessels had earlier failed to deliver from deepwater wells off western Ireland. Sovereign Explorer's dry hole was on Statoil's Sarsfield prospect in 650 meters water depth, 170 km off the Kerry coast. The partners had hoped for a potential 500 million BOE discovery, based on seismic analysis. West Navion failed also with its Enterprise-operated wildcat on the Errigal prospect, in 1,600 meters water depth off northwest Ireland.

Western Ireland's Corrib

Enterprise's recently authorized Corrib Field development is the sole successful campaign off western Ireland to date. Ramco Energy hopes to have better luck in the Celtic Sea. The Pride North Sea was due to start exploring its Seven Heads/Galley Head acreage last month, with an option for a second well.

Ramco is thought to be chasing gas, which is a hot commodity on the Irish mainland. A new overland trunkline system will be supplied partly by Corrib, but also from supplies through a new 194 km, 30-in. Interconnector line to be laid between southwest Scotland and Gormanston in County Dublin. Allseas could begin installation early next year.

Dutch sector

In the Dutch North Sea, most of the main players have been drilling new prospects this season. At least two wells are thought to have yielded discoveries. BP's P/15-15, drilled by Ensco 8, found gas - according to analysts Wood Mackenzie, it was targeting the Triassic Bunter sands formation. The discovery is thought to be within reach of the Rijn Field infrastructure. Wintershall is thought to have found up to 350 MMcf/d via its F/16-3 discovery well in March, which was followed by a further well on E/18, a few kilometers to the northwest.

The development scene has picked up of late, with NAM announcing plans for three new platforms on separate fields, known as the Neptunus project. Each would have a single gas processing train, glycol dehydration, and producer water/condensate handling equipment. They would be built and installed by summer 2003. Gaz de France's 100 bcf discovery in the remote G/17 block to the north is also under development, with a new pipeline linking into the NGT export system. Clyde may also opt to use this new line for its 90 bcf Bunter discovery M/7-5.

Danish sector

Finally, Danish sector oil reserves jumped 26% last year to 299 MMcm, according to figures from the Danish Energy Agency. That compares with 200 MMcm throughout the 1990s. The improvement is due to new discoveries last year such as Nini and Cecilie, but also an upgrade of Mærsk's Halfdan, the most important Danish North Sea find of recent times.

Exploration prospects generally have improved since the government introduced its open door licensing policy for parts of the Central Graben, bringing in a series of new players. That contrasts with the Dutch government's negative stance on new activity in the Dutch sector.

One area of concern to the DEA is stability of Denmark's older platforms. Production from the Tyra Field reduced fluid pressure in the chalk layers, leading in turn to compaction of the overlying layers and subsequent seabed subsidence. DEA predicts that as the platforms sink, wave impact will become noticeable higher up. The changing load pattern could force structural modifications to the platforms. It may also prove necessary to relocate certain equipment away from the cellar decks to ensure safety of personnel and other equipment items. Last year, structures on platform in the Dan B complex had to be reinforced with concrete, following reassessment of their wave load capability.